Financial inclusion: Learning from cash for better products

Financial literacy is highly valuable, but the prevailing idea that education is the only solution to financial exclusion often overlooks

Financial literacy is highly valuable, but the prevailing idea that education is the only solution to financial exclusion often overlooks

Karen Nadasen, CEO of PayU Africa, highlights how digital payments are driving financial inclusion across Africa, enabling economic opportunities and transforming access to financial services.

Mobile money is enabling millions in Sub-Saharan Africa to access financial services, driving economic growth, and empowering underserved communities, particularly women, through innovative digital solutions.

PayU’s Marius Costin on how fintech is paving the way for financial inclusion.

Semtech CEO Mohan Maheswaran on LoRa’s role in building IoT for a truly sustainable digital future.

HSCNI, Microsoft and Kainos on their world-beating response to the COVID-19 challenge.

ISP proxies help e-commerce businesses monitor competitors, access region-specific pricing, and run data tools smoothly, without getting blocked, ensuring better market insights and decisions.

City of Atlanta CIO Gary Brantley on how two very different viruses have enabled opportunity for lasting change

Heightened climate impacts prompt action, regulatory focus on greenwashing, climate technology adoption, and pivotal elections.

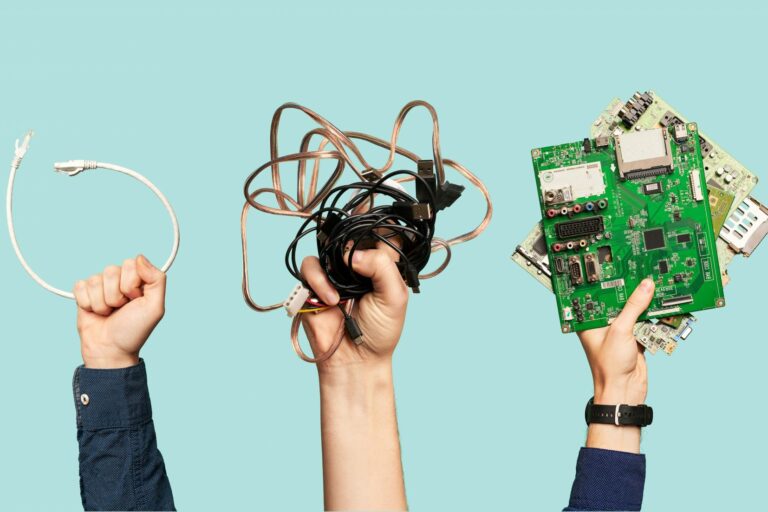

Iron Mountain’s Stuart Bernard says data protection, e-waste and recycling go hand-in-hand for organisations today

Anders Bergtoft is CEO of Charge Amps. In this podcast, Anders charts the EV revolution and discusses the hurdles still to overcome.

Blockchain could provide a transparent, safe, and incentivised mechanism for the distribution of welfare, says Accenture’s Chloe Tartan.

Financial literacy is highly valuable, but the prevailing idea that education is the only solution to financial exclusion often overlooks

Karen Nadasen, CEO of PayU Africa, highlights how digital payments are driving financial inclusion across Africa, enabling economic opportunities and transforming access to financial services.

Mobile money is enabling millions in Sub-Saharan Africa to access financial services, driving economic growth, and empowering underserved communities, particularly women, through innovative digital solutions.

PayU’s Marius Costin on how fintech is paving the way for financial inclusion.